Intel's Fab 52: A Critical Turnaround

In the heart of Chandler, Arizona, Intel has opened its state-of-the-art semiconductor fabrication plant, Fab 52, marking a pivotal moment in its quest to reclaim dominance in the competitive chipmaking industry. After substantial investment and years of development, this facility represents not just an expansion of production but also a strategic play to revitalize Intel’s faltering business against industry giants like TSMC and Nvidia.

The Strategic Importance of 18A Technology

At the center of this revival is Intel’s new 18A process technology, designed to enhance performance and efficiency. This technique promises to enable the production of advanced chips that can cater to a burgeoning market, especially in artificial intelligence (AI) and high-performance computing. As AI continues to surge in demand, Intel's ability to attract clients from the lucrative AI sector depends on successfully deploying this new technology.

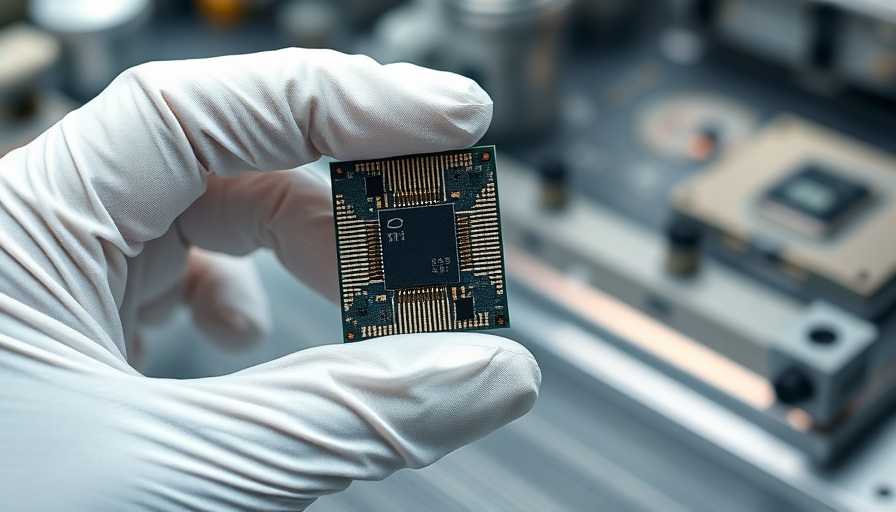

A Factory Like No Other

Intel’s Fab 52 is not just another chip plant; it's heralded as potentially the most advanced manufacturing facility globally. Robots handle most operations within the fab, and air purity is maintained to exclude any contaminants. Visitors to the facility are immersed in a futuristic environment where silicon wafers are treated with utmost care to prevent even the slightest contamination that could compromise production integrity.

The Competition Landscape

Intel's comeback isn't without challenges. The firm has struggled to keep pace, particularly when it comes to volume production and timely advancements compared to rivals like Taiwan's TSMC, which has successfully leveraged its manufacturing capabilities to secure a leading position in the market. Analysts highlight that while Intel may excel at developing new technology, its execution must match the efficiency and output levels set by its competitors.

Government's Role and Financial Backing

The recent financial stake in Intel by the Trump administration highlights the intersection of technology and policy in America’s semiconductor landscape. With an $8.9 billion investment, there is a clear push from the government to ensure that the U.S. remains a key player in semiconductor manufacturing. This aligns with broader conversations about national security and the growing dependency on foreign semiconductor production.

Future Trends in Chip Manufacturing

As generative AI transforms the tech landscape, there's an increasing necessity for specialized chips that can handle vast computational tasks. Intel’s CEO, Pat Gelsinger, emphasizes a keen awareness that the company must not only produce better chips but also foster strategic partnerships. For instance, collaborations with tech giants like Microsoft signal a crucial step in rebuilding trust and reliability in Intel’s manufacturing prowess.

The Bottom Line: Intel's Resurrection?

Intel stands on the precipice of a crucial turnaround. With Fab 52 operational, the company is attempting to reverse a decade-long trend of missteps. The success or failure of this new manufacturing plant will likely serve as a key indicator of Intel’s ability to navigate not just its business recovery but also the evolving dynamics of global technology and AI advancements. The outcome may well determine whether Intel reclaims its legacy as a trailblazer or continues its decline amid fierce competition.

For marketing managers in tech, the developments at Intel are significant. Being aware of industry shifts, like the rise in AI demand and government interventions in manufacturing, presents opportunities to strategically position products and partnerships. Understanding how Intel is adapting could provide insights into future market trends and consumer behaviors.

As the tech industry evolves, keeping track of companies like Intel amidst government support can provide unique insights that excessively shape marketing strategies and product development.

Add Row

Add Row  Add

Add

Write A Comment